• Millennials Are Buying, Not Building

• What Buyers Study Before They Call

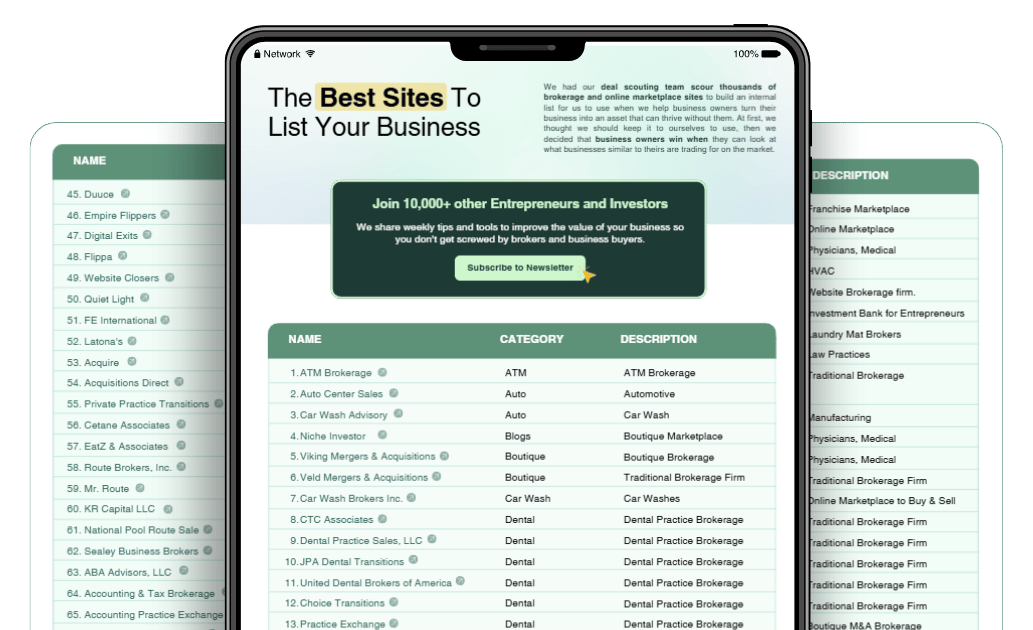

• Free Guide! 70 Sites To List Your Business

The Business Buying Wave is Here – Are You Ready to Ride It?

There's a massive shift happening in the business world right now. Millennials used to aspire to jobs in investment banking and private equity, but now want to become entrepreneurs. But their entry point into entrepreneurship is different. They don’t want to build. They want to buy.

If you are a business owner, this may seem like a good thing. More buyers mean more demand for your business, but there’s a problem.

After COVID, a trend started.

Creative financing (which is a code word for making the business owner become the bank in a deal) used to be a tool to bridge a small gap in price expectations. If I wanted to sell for $5M and you thought my business was only worth $4M, then we could combine seller financing and an earn-out to get us across the finish line.

But that's not what these buyers now learn in these business buyer cohort-based programs run by marketers masquerading as investors.

But here's the thing: these buyers aren't coming to the table empty-handed. They've got sophisticated tools, market research platforms, and comprehensive databases that tell them exactly what your business is worth, how it compares to competitors, and whether you're pricing it right. Meanwhile, most business sellers are flying blind.

When I was told my trampoline park was "unsellable" in 2018, I felt that disadvantage firsthand. I thought my business model was the problem – until I started digging deeper. I discovered something eye-opening: other trampoline parks in my sector were selling for 5x+ multiples while I was stuck thinking mine was worthless. One big difference? They were running membership models instead of pay-per-visit pricing like I was.

How did I figure this out? I started researching the businesses that were on the market actively trying to sell.

The Power of Market Intelligence

Today's buyers spend hours on listing sites, analyzing businesses for sale, studying revenue models, and understanding market dynamics before they ever reach out to a seller. They know your industry better than you might think they do.

The good news? You can level the playing field.

By researching these same platforms, you can discover:

What multiples are the businesses in your industry currently commanding

How successful competitors structure their revenue (memberships vs. one-time sales vs. service contracts)

What operational metrics buyers are focusing on

How other business owners present their employee structures and inventory systems

Proof of demand for new potential markets you can expand into

Your Competitive Intelligence Toolkit

We've compiled the 70 most valuable listing sites where you can research businesses for sale, understand market dynamics, and see how your peers are positioning their companies.

Whether you're thinking about selling in 2 years or 10 years, this intelligence helps you:

Identify ways to increase your business value now

Understand what buyers in your market are looking for

Spot industry trends before your competitors do

Price your business competitively when the time comes

The business buying wave is accelerating. The question is: will you be ready to take advantage of it?

Get Your Complete Guide

Download our comprehensive list of the 70 Best Business Listing Sites for market research, competitive intelligence, and deal flow analysis. Plus, fill out our quick survey to schedule a conversation about your specific situation.

After downloading, you'll see our brief survey. We'd love to learn more about your business and share additional insights that could help you navigate this market.

The EXITOS newsletter delivers actionable insights for trade and service business owners who want to build valuable, sellable companies. Forward this to a fellow business owner who could benefit from these insights.

To your next big move,

Raleigh “Do you” Williams

Founder of ExitOS

Our Top Reads

How to Buy a Business with an SBA 7(a) Loan

Your roadmap to owning a business without breaking the bank 💼💰

10 Commandments of Investing: Essential Rules for Success

An Insider's Guide to Avoiding Pitfalls & Capitalizing on Lucrative Investments